The University of Pittsburgh’s Investment Office has released the fourth Consolidated Endowment Fund Environmental, Social and Governance Report. The Fiscal Year 2024 report continues to enhance transparency regarding the Consolidated Endowment Fund (CEF), implementation of the University’s Environmental, Social and Governance (ESG) Policy, and provides an update regarding the endowment’s fossil fuel exposure.

This report directly supports the progress of a Pitt Sustainability goal:

Increase Pitt community understanding about the purpose and management of the Consolidated Endowments Fund (CEF), including education and engagement about the CEF’s aggregate status, trends, and current and future fossil fuel exposure (including the basis for any material changes in expectations).

Some highlights from the FY24 CEF ESG Report include:

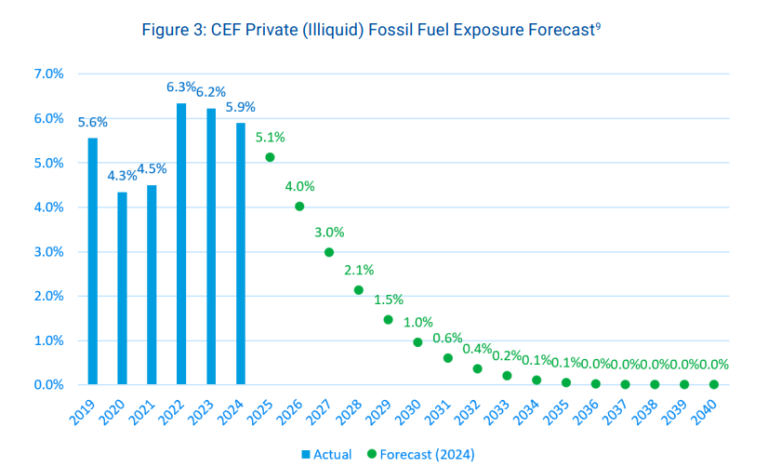

- As of June 30, 2024, the CEF was valued at $5.7 billion. Total (public and private) exposure to fossil fuels decreased to 7.8% from 8.2% in FY23.

- Private investments exposure to fossil fuels is currently projected to become de minimis around 2036 given current trends.

- Fossil fuel exposure for public investment, which is held indirectly via index funds and funds managed by external investment managers, is expected to continue to fluctuate over time. Between FY23 and FY24 there was a 0.1% decrease in exposure for public investments.

- The Investment Office has not made any direct investments in fossil fuel companies or new commitments to fossil fuel-focused funds in over four years.

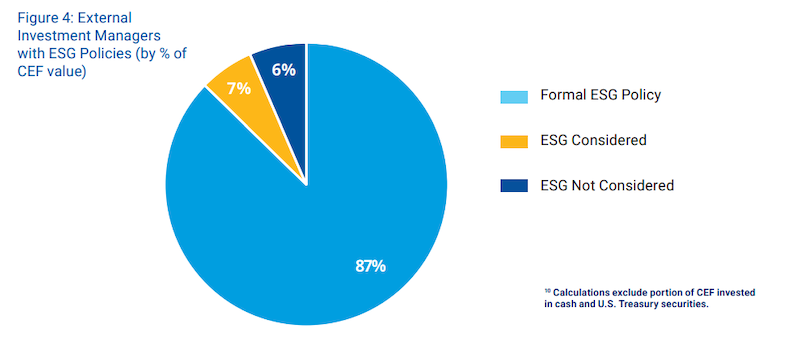

- 94% of the CEF has formal ESG policies in place or have indicated that they take ESG considerations into account when making investments.